A blog in support

of the

Facebook group

Canaccord and other ABCP Clients

How Safe Is Your RRSP?

March 5, 2008

I have a friend who has an RRSP. He is self employed. This RRSP is his pension.

Last July he sold the remaining stocks in the plan and directed all funds be placed in a safe, short term, money market fund like T-Bills

His full service broker at Canaccord Capital purchased a 30 day note that paid a competitive rate of interest.

It's highly rated AAA paper, as good as cash

Not long after, and much to his surprise, he discovered he had purchased Asset Backed Commercial Paper (ABCP). The markets froze Aug 13, 2007.

More than 7 months later he has not seen a dime. There is a chance he never will. The account is frozen. He cannot cash it in, he cannot borrow against it. At the present time, it is worthless.

My friend is not alone. Jill in Victoria had purchased a new home after selling her condo. The closing for the new home was in six weeks. So she instructed her investment dealer to put her home equity, cash at this point, into a short term interest bearing note to mature before home possession date.

Suddenly, her home equity not available, not available for 7 months now, and counting.

Jill's employer (bless them) offered some emergency financing, which allowed her to take possession of her home.

Now the bankers and lawyers are saying maybe not for another 10 years! And maybe not at all! We will make an announcement any day now, like we have being promising for for 7 months!

The Banking Crisis

The ABCP liquidity crisis is worldwide. It keeps getting worse.

In the United States, we watch as the big investment banks like Citigroup, Bear-Stearns, and Merrill-Lynch assume huge losses and sack the bosses. The SEC launches investigations. The Feds step in with a rate cut.

In Britain they have the first run on a bank in more than 100 years. It unfolds like a Mary Poppins movie. The government steps in.

But here in Canada, our government and our central bank sit on their hands.

Instead, we have Canada's Financial Establishment step in to prevent a run on their banks.

They freeze $33,000,000,000 (33 billion) in payables, more than Bill Gates has in his chequing account, and they call it a stand-still agreement. They give this agreement an impressive sounding name - The Montreal Accord.

My friend started a group on Facebook - Canaccord and other ABCP Clients. It'a a private group now, almost 100 members and growing fast. You can join! (more on that later)

From the Montreal Accord evolved a committee with an even more impressive sounding name: The Pan-Canadian Committee. The members include Canada's Big Banks, Bay street lawyers, investment dealers, the largest pension funds in the country, and other rich guys in nice suits and shiny shoes. They meet behind closed doors to work out a deal.

They promise a resolution, but almost 7 months later, there are still only promises. Press releases from the Committee, if they are made, are now issued on Friday after the close of business.

Meanwhile, the ABCP situation continues to get worse. Some people get paid, but others get hung out to dry. The possibility of losing their home or their pension is very real.

It's an absolutely amazing abuse of power by the Canadian Establishment. Our governments and governors curiously allow this to happen.

Have I Got a Deal For You!

The Pan Canadian committee, chaired by prominent Bay street lawyer Purdy Crawford, float a trial balloon deal. The notes will be restructured.

Instead of maturing in 30 days, like they were supposed to back in August 2007, they will now mature in 7-10 years, whereupon the note holders will almost certainly get their principal back. Their solution is to swap the old short term notes for long term notes, straight across.

There is some fine print: Those who accept this offer give up the right to sue the bank or investment dealer that sold them the original note.

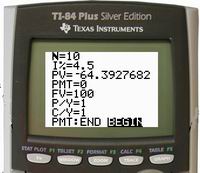

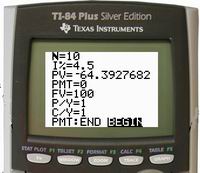

These days, high school students who strive for university admission learn how to calculate Net Present Value (NPV). It's the time value of money, that whole miracle of compound interest thing.

The 64¢ solution

A question on an Alberta Math 20 final might be as follows:

Q. As a graduation gift, your grandmother gives you a Government of Canada marketable bond that matures in 10 years for $100.

You check the Bank of Canada web site and discover that these bonds yielded 4.5% interest on the date they were auctioned back in July of 2007.

What did Grandma pay for this bond, ignoring all 'professional' fees?

A. $64.39

This is the NPV of the 10 year deal the Pan-Canadian committee is proposing, a 64¢ solution to the $33 billion question. And that's if you hang in there for the whole term. The experts tell us expect a discount to cash out early.

Since no official name has been assigned to this new structured investment product, may I propose one now? How about the Pan-Canadian Banker/Bullshit Swap (PCBS)? Select the adjective you think most appropriate.

Money, Money, Money...

The financial community has made a lot of money over the last few years in creating and trading these complicated products. Quantum mechanics can be easier to understand than CDS's, SIV's, CDO's and financial derivatives.

But the highly paid experts who deal in these matters have repeatedly assured us that the quality was high because the risk was spread.

No worries - these are AAA rated and pay a slightly higher interest rate.

Suddenly, we are advised that there is a downside. They say read the fine print. Interest bearing notes with a very small upside also have a HUGE downside, many, many times more than the interest one was hoping to earn. So the banker/broker says…

Sorry, about that. There was like a 1 in 10,000 chance of that happening, that's why we didn't make a big deal about it. But whadda know? Shit happens. We in the industry call this a Black Swan event.

Facebook - new media to the rescue?

As I was saying, my friend started a group on Facebook - Canaccord and other ABCP Clients.

The group received some attention from the media. Sadly, I think the media were more interested in the novelty of a Facebook group than in any impropriety occuring. In the old days we would call the media, now, instead, we create a web page.

Since then there has been a little media coverage on this issue. The stories of the retail investors are rare.

At first this was an open group - all discussions and postings were open to anyone on the internet. But as the members revealed their circumstances to each other, more discretion was properly applied. It is a private group now, just like the Pan-Canadian committee. Unlike the committee however, you are encouraged to join if you own ABCP, or if you feel you can help. If this is the case, just ask.

It's a little unfortunate that it's a private group now because it makes it harder to get the message out.

There are almost 200 members now it is growing fast.

Many of them must be new to Facebook; they have no picture posted and they have no friends (ha-ha, just kidding). They are mainly older folk, many retired; not the typical Facebook demographic.

Here is one recent excerpt from a posting (one that did have a picture)...

I want to thank you for what you are doing for us individual investor.

I am 72 years old, retired and on a fixed income and have $200,000.00 in this crap with Canaccord. I sold some stock in anticipation of the stock market making a correction and ask Canaccord to buy Canada T-Bills. ... Thanks for listening. (the picture is of my son as I do not have a face book account).

The stories presented in this group are compelling and heart wrenching. These are not the tales of fools who expected to double their money every month, or anticipated a windfall for assisting in a dodgy withdrawal from a bank in Nigeria.

These are people who socked away money for 30 years for retirement or for a home. Some are retired. All they wanted was to earn a little interest, something better than the 0% offered in a chequing account. Just for a month or two or three.

Now they have been hung out to dry. 7 months and counting. There is a very real fear and possibility they could lose everything.

The International Monetary Fund (IMF) recently issued a report praising Canada for the strength of its banks. They are are conservative, well managed, and have been very profitable, as most Canadians who have occasion to use those bank machines have discovered.

The same report scolded Canada for its lax securities regulation. White collar crime in this country operates with little fear of prosecution.

Canada's Finance minister, Jim Flaherty, was flattered by the report; but he made note of its criticisms regarding Canada's lax securities regulation. Mr. Flaherty took the bold step of appointing another committee.

This is not enough. The last committee that recommended a national sercurities regulator was chaired by Purdy Crawford himself only two years ago.

Now Mr. Crawford is acting on behalf of the banks and investment dealers?

Why form another committee? It's been done before. What does this accomplish?. It needs to be recognized that the status quo is not acceptable here.

This month former Establishment man Conrad Black reported to jail. We can thank the SEC and US justice system for finally making this happen. The authorities in Canada seem to be incapable of this.

Two decades ago, Lord Black raided the pension plan of Dominion Stores as he was firing the workers and closing their stores. He nearly got away with it, because he could.

Since then the rules have changed. Company sponsored defined benefit pension plan are almost extinct. Companies don't like the risk, the liability, and the citizens of Canada have little reason to trust them.

Lord Black is one of the reasons why most of us now have our own RRSP plans. We have assumed the risks (and rewards) for ourselves. But the playing field needs to be level here.

The problem, the solution…

The Montreal Accord (the stand-still agreement) is nothing more than a $33 billion interest free loan to Pan-Canadian Committee members while they sort out a mess of their own making.

This is wrong. This is so wrong. Our leaders need to hear from all of you.

According to the IMF, Canada's banking system is sound enough to take the hit. Let them take it. Let them take the responsibility as they should.

There is no better time than now to establish a national bank and securities regulator that can sort this mess out NOW, correct the wrongs to the citizens of Canada, and restore the law of the land. There is no one else that has the resources to take on this establishment.

Who knows, having a Big Bank take it in the chin might even end up being a good thing?.

So, how safe is your RRSP?

Rt. Hon. Prime Minister Harper

Rt. Hon. Prime Minister Harper;

Hon. Jim Flaherty, Finance Minster;

Sirs,

You need to sit down with the Governor of the Bank of Canada and deal with this situation properly and fairly. The citizens of Canada are having their property stolen by greedy bankers and lawyers. This is wrong.

Hon. Jim Flaherty

Minister of Finance

House of Commons

Ottawa, CANADA

K1A 0A6

Telephone: (613) 992-6344

Fax: (613) 992-8320

e-mail:

Flaherty.J@parl.gc.ca

Prime Minister Stephen Harper

80 Wellington Street

Ottawa, CANADA

K1A 0A2

Fax: (613) 941-6900

e-mail:

pm@pm.gc.ca